2022 marks the 10th anniversary of Emily Whitehead, the world's first child with leukemia cured by CAR-T cell immunotherapy, achieving cancer-free survival.

In 2012, Emily, who suffered from acute lymphoblastic leukemia (B-Cell Acute Lymphoblastic Leukemia), participated in a CAR-T clinical trial for childhood B-cell acute lymphoblastic leukemia launched by Philadelphia Hospital when her disease relapsed for the second time and there was no drug to treat it. After three weeks of CAR-T treatment targeting CD19, Emily's cancer cells completely disappeared. Ten years later, there is still no recurrence.

Emily's photo

(Source: public information, please delete if infringed)

The "miracle" of tumor cure that happened to Emily has inspired countless elites in scientific research and industry to explore CAR-T cell immunotherapy in depth, and related products have been approved in recent years - the US FDA has approved 6 CAR-T products, the EU has approved 3 CAR-T products, and there are currently 2 CAR-T products approved in China.

| Approval Status | Serial number | common name | Product Name | Manufacturer | Approval time | Indications |

| FDA approved | 1 | Ciltacabtagene Autoleucel | CARVYKTI | Legendary Creatures | 2022 | Adults with relapsed or refractory multiple myeloma |

| FDA approved | 2 | Idecabtagene Vicleucel | ABECMA | Celgene Corporation | 2021 | Adults with relapsed or refractory multiple myeloma |

| FDA approved | 3 | Lisocabtagene Maraleucel | BREYANZI | Juno Therapeutics | 2021 | Relapsed or refractory large B-cell lymphoma in adults |

| FDA approved | 4 | Brexucabtagene Autoleucel | TECARTUS | Kite Pharma | 2020 | Relapsed or refractory large B-cell lymphoma in adults |

| FDA approved | 5 | Tisagenlecleucel | KYMRIAH | Novartis Pharmaceuticals Corporation | 2017 | Relapsed or refractory B-cell precursor acute lymphoblastic leukemia in patients under 25 years of age and relapsed or refractory large B-cell lymphoma in adults |

| FDA approved | 6 | Axicabtagene Ciloleucel | YESCARTA | Kite Pharma | 2017 | Relapsed or refractory large B-cell lymphoma in adults |

| EU approved | 1 | Brexucabtagene Autoleucel | TECARTUS | Kite Pharma | 2020 | Relapsed/refractory mantle cell lymphoma in adults |

| EU approved | 2 | Axicabtagene Ciloleucel | YESCARTA | Kite Pharma | 2018 | Diffuse large B-cell lymphoma; primary mediastinal large B-cell lymphoma |

| EU approved | 3 | Tisagenlecleucel | KYMRIAH | Novartis Pharmaceuticals Corporation | 2018 | B-cell acute lymphoblastic leukemia; diffuse large B-cell lymphoma |

| Domestic approval | 1 | Akilencel injection | Yikaida | Innovent Biologics | 2021 | Diffuse large B-cell lymphoma, primary mediastinal large B-cell lymphoma, and high-grade B-cell lymphoma |

| Domestic approval | 2 | Requiorencel Injection | Benoda | Fosun Kate | 2021 | Relapsed or refractory large B-cell lymphoma in adults after two or more lines of systemic therapy |

Current approval status of CAR-T products worldwide

(Collated from public information, mapped by Artery Network)

Emily's "miracle" is a very typical case of cell therapy products, but in fact, there are other immune cell therapy products including DC products and stem cell products including hematopoietic stem cells (HSC) and mesenchymal stem cells (MSC), which are performing similar "miracles" to Emily on different patients.

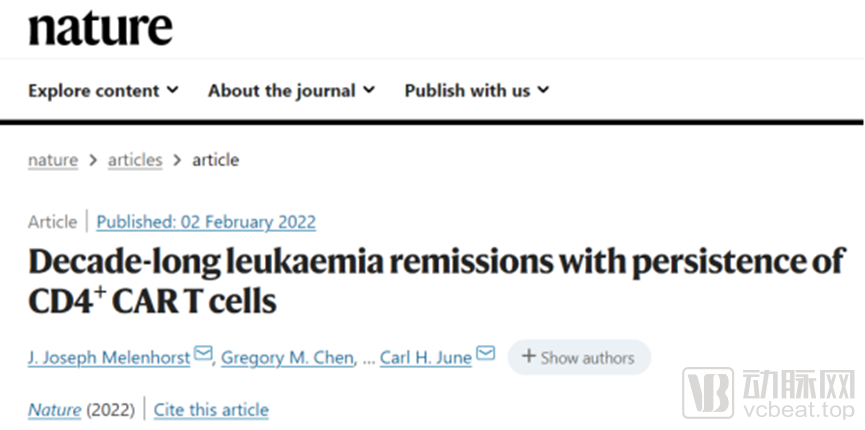

Recently, the top academic journal Nature published a research report on the long-term potential and stability of CAR-T cell therapy for leukemia. The team led by Professor Carl June, the world-renowned father of CAR-T, found through long-term research that in two patients with chronic lymphocytic leukemia, active CAR-T cells can still be detected after ten years. Although the number is low, it is measurable and retains lethality, which has led to sustained relief of the patients' condition.

The hope and emotion behind these miracles have contributed to the hot development of the global cell therapy track. Europe and the United States have approved dozens of cell therapy-related products. Looking at China, with the approval of two cell therapy products last year, Fosun Kite's Ikaida (Akilencel Injection) and Innovent Biologics' Benoda (Rekioluncel Injection), Legend Biotech/Johnson & Johnson's BCMA CAR-T therapy product cilta-cel (trade name Carvykti) was successfully "exported" this year, which greatly boosted the confidence of the domestic industry and market in the development of the cell therapy industry, and also made them more enthusiastic about the cell therapy track.

Countless companies are working hard to actively promote the research and development of their own cell products; countless capitals have scattered money and bet on their own promising cell therapy start-ups.

The situation that has emerged is that China currently leads the world in the number of cell therapy clinical trials, second only to the United States; in 2020 alone, the total amount of financing in the domestic cell therapy field reached 12.6 billion yuan, and the compound growth rate of financing in the cell therapy field from 2016 to 2020 reached 118.8%.

Investment and financing of the domestic cell therapy industry from 2016 to 2021

(Source: Frost & Sullivan report)

The entire cell gene therapy industry has begun to enter the industrialization stage on a large scale. The success rate and speed of product development have become the key to the success of enterprises.

The industrialization verification and pharmaceutical process development of cell drugs are the "speed-limiting steps" that plague the current innovative drug companies in promoting the industrialization of cell drugs. Therefore, how CDMO can help the industrialization process of cell therapy has become the focus of the industry. The hot development of the cell therapy track has directly led to the arrival of the "spring" of the cell therapy CDMO industry.

The cell therapy industry has a stronger demand for CDMO

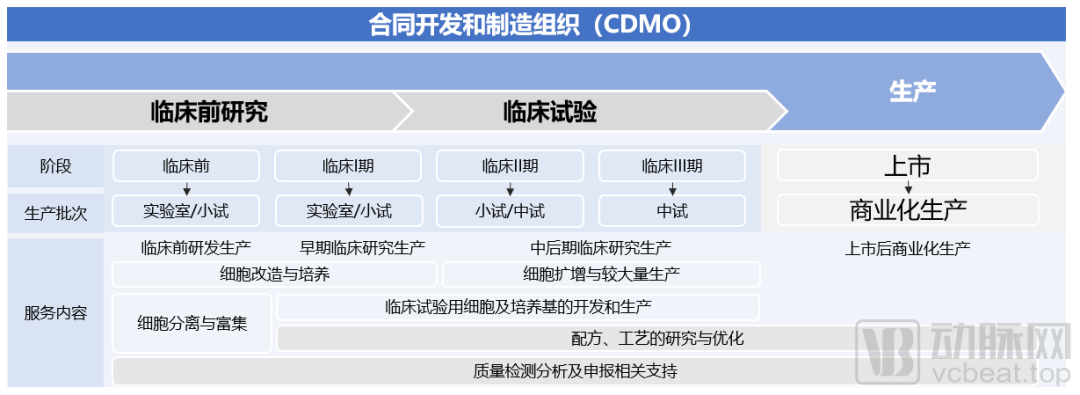

The function of cell therapy CDMO is mainly to provide cell therapy companies with process development and preparation of clinical new drugs, as well as process optimization and large-scale production services for marketed drugs, including the production of drugs for preclinical and clinical trial research and commercial drug production.

Overview of CDMO services

(Source: Frost & Sullivan report)

Its role in the industry includes reducing the production risks and costs of early-stage cell therapy drug development, shortening the company's R&D cycle, and meeting regulatory compliance requirements for product quality and safety, which is similar to the application demand scenarios of CDMO in the traditional drug field.

But the difference is that the cell therapy industry has a stronger demand and willingness for CDMO.

The reasons behind this are mainly reflected in three aspects:

1. As an emerging track, related companies are mainly start-ups, and many companies tend to use funds for pipeline development, team building, etc.;

2. Compared with traditional drug development, cell therapy drugs require higher R&D investment;

3. The production process of cell therapy drugs is complex and has a higher threshold.

As an emerging track, related companies in the cell therapy industry are mainly biotechnology start-ups, and traditional pharmaceutical companies with large scale are a minority. Start-ups often lack strength in terms of funds, talents and other resources, but face difficulties such as high capital cost for self-owned production capacity construction, slow construction speed, long verification time, and the need for a large number of production, QC and other personnel. Therefore, compared with the demand for CDMO in other traditional drug fields, the demand for CDMO in the cell therapy track is more vigorous and urgent.

According to the report of Frost & Sullivan, the R&D costs of cell/gene therapy in the discovery and preclinical stages are between US$900 million and US$1.1 billion, and the costs in the clinical stage are between US$800 million and US$1.2 billion; the high investment in the development of cell therapy drugs makes cell therapy companies have a high demand for using professional outsourced R&D and production teams to reduce drug development costs.

Regarding the cost of cell therapy drugs, Wang Liqun, founder of Synyon Bio and former CEO of Fosun Kite, once publicly stated that once the CMC of cell therapy drugs is changed, it is a "completely different product", and once the product is declared, there is not much room for cost reduction. Therefore, the cost reduction of cell drug products should be considered from the beginning of the project. "The experience of the first product can be used in the development of the second and third products through innovation." Wang Liqun said.

However, since most companies lack experience in the development of cell drugs, and the success of the first product is extremely critical, professional cell therapy CDMOs with mature basic research capabilities and development and transformation experience in cell therapy provide pharmaceutical companies with another more reliable option. By providing a full range of solutions, CDMO can help companies improve R&D efficiency and control risks, and ultimately achieve the commercialization of cell products.

In addition, due to the R&D challenges faced by cell therapy drugs, such as the difficulty of large-scale production and high technical barriers to process optimization, companies in this field have a stronger demand for CDMO services. Compared with traditional macromolecule and small molecule drugs, cell drugs have higher R&D and production requirements: not only do they need to build cell libraries, select and optimize viral vectors, and culture cells on a large scale, but they also have more stringent requirements for quality inspection, batch stability, preparation and transportation, and medication.

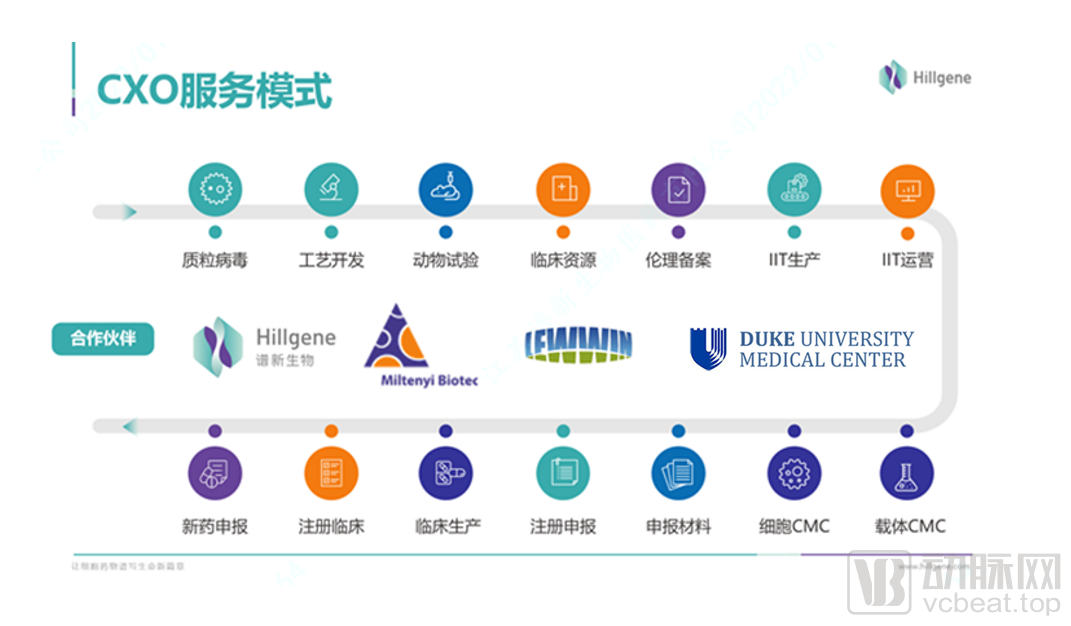

Cell therapy CDMO companies usually have large cell or vector libraries, which can help pharmaceutical companies select suitable cells or vectors and optimize processes, thereby reducing trial and error costs and improving R&D efficiency and success rate; their rich production platforms and strict quality inspection measures can help pharmaceutical companies reduce commercial production costs and time - professional QA/QC personnel and strict supervision of the entire process will ensure that the production of cell therapy products meets national GMP quality standards. In addition, some cell therapy CDMO companies can provide one-stop regulatory services such as new drug clinical trial applications (IND) and new drug marketing applications (NDA), further helping pharmaceutical companies to speed up their R&D progress.

In general, cell therapy CDMO can complete the standardized production of target products in a "more, faster, better, and more economical" manner, while meeting the customized needs of pharmaceutical customers, helping pharmaceutical companies complete the declaration of cell drugs and achieve stable supply.

However, the many advantages of cell therapy CDMO mentioned above can only be established under the premise that cell therapy CDMO is very mature and professional. If a cell therapy CDMO is not mature and professional enough, then pharmaceutical companies will definitely have many concerns and doubts when entrusting their own cell drugs to CDMO. So, how is the development of the domestic cell therapy CDMO track? In the cell therapy industry full of "gold digging" teams, which dark horse will be the first to break out of the "water selling" team?

The domestic cell therapy CDMO industry is still in its early stages of development, and very few companies can provide mature services

Artery Network has previously conducted a related inventory of the field of gene cell therapy CDMO and found that there are very few companies in China that specialize in cell therapy CDMO services. Most CDMO companies will provide gene and cell therapy CDMO services at the same time. Spectrum Bio may be the only provider in China that focuses on developing overall cell therapy CDMO solutions. The company has recently completed a Pre-A round of financing of nearly 100 million yuan, led by Puhua Capital.

As an emerging development track in the medical field, cell therapy undoubtedly requires certain strength and courage for start-ups to choose to bet on such a niche field, because the risks are really not small. To better understand a company that chooses to take the path that only a few companies take, focusing on the cell therapy CDMO segment, we had a conversation with Dr. Zhu Yi, CEO of Spectrum Biopharmaceuticals.

Why did you choose to focus on cell therapy CDMO services? Dr. Zhu Yi said that this choice was entirely based on the strength and advantages of the company's team. The Spectrum Biopharmaceuticals team had developed related cell therapy products in the early stage and accumulated a lot of experience in the development and production of cell drugs. Based on its own understanding and development capabilities of cell drugs, Spectrum Biopharmaceuticals can help customers avoid the "pitfalls" that may be encountered in the development and production of cell drugs and smoothly solve many problems that may be encountered in the process, thereby helping customers "take fewer detours."

"Compared with CDMO services in the field of antibodies and small molecules, cell drug CDMO services are unique, with huge differences in process and production standards. Therefore, in addition to conventional cGMP, production capacity, quality and other requirements, cell drug CDMO companies also have higher, newer and more important requirements - a deep understanding of cell drugs and industrial transformation capabilities." Dr. Zhu Yi said that it is a very challenging issue to examine CDMO services from the perspective of making drugs, especially for cell drugs, whose research and development and production are closely linked.

Novartis, a leader in the field of cell therapy, has repeatedly chosen to cooperate with Oxford Biomedica (OXB) in the production of cell drugs, which is a good proof. Oxford Biomedica was founded in 1995 and listed in 2001. It is known as a pioneer in the field of lentiviral vector gene therapy. It has a patented technology LentiVector gene delivery platform and has developed a number of gene therapy products based on it. At the same time, it provides gene and cell therapy CDMO services to the outside world. Novartis has been working closely with Oxford since 2013 due to its unique experience in developing and producing gene therapy products. It has repeatedly selected Oxford to provide clinical supply services for lentiviral vectors for the company's CAR-T candidate products.

| Cooperation time | Specific cooperation content |

| May 2013 | Novartis announced that it has signed an agreement with Oxford BioMedica to use its patented LentiVector (lentiviral vector) gene delivery system to provide clinical-grade materials for the manufacture of Novartis' CAR-T candidate product CTL019. |

| October 2014 | Novartis and Oxford BioMedica have signed a $90 million collaboration agreement to further expand their collaboration in the CAR-T field. |

| July 2017 | Novartis and Oxford BioMedica have signed another contract worth up to $100 million. Oxford will provide clinical supply of lentiviral vectors for Novartis' CAR-T star product CTL019 (tisagenlecleucel) and other undisclosed chimeric antigen receptor T cell (CART) products. |

Novartis and Oxford Biomedica have had many strategic collaborations

(Collated from public data, mapped by Artery Network)

Similarly, Spectrum Bio, which delivers orders based on drug development standards, will provide customers with truly feasible rectification plans based on timely discovery of problems, even at the product design level. "This places high demands on our team, but it greatly reduces the obstacles in the subsequent development of products. Ensuring the speed of each stage while ensuring the success rate of product development is the added value that Spectrum Bio's services can provide to customers. We believe that such services are very valuable to customers."

The first registered clinical production project undertaken by Spectrum Bio is a Phase I/II CAR-T cell drug project. Based on the full-process experience of early research and development of this cell drug, IND application, registered clinical production, etc., Spectrum Bio has established a complete, three-dimensional, and mature full-process service capability.

The current situation of domestic cell drug CDMO companies is that most companies are still in the process of crossing the river by feeling the stones and growing together with customers, and few companies have the experience of delivering mature cell drug projects. Spectrum Bio is one of the very few CDMO companies in China that has the actual experience and ability to undertake such projects. This is an important reason why it can still develop well in the industry when many leading and start-up companies are deploying cell therapy businesses.

As one of the earliest companies in China to deploy cell drug CDMO services, Spectrum Bio has more than 100 industrial customers. The company started independent operation at the end of 2020 and received orders of 120 million yuan in 2021. In August 2021, Spectrum Bio and Promis Biotechnology reached a comprehensive strategic cooperation on the commissioned development and production of cell therapy drugs. With its process development capabilities and cell drug GMP production capabilities, it provides CDMO services for Promis's multiple new CAR-T cell drugs.

"Customers' trust in Spectrum Bio is the best proof of our capabilities." Dr. Zhu Yi said happily.

New documents on stricter GMP cell therapy products have been released, which is a boon to companies that build factories with high standards

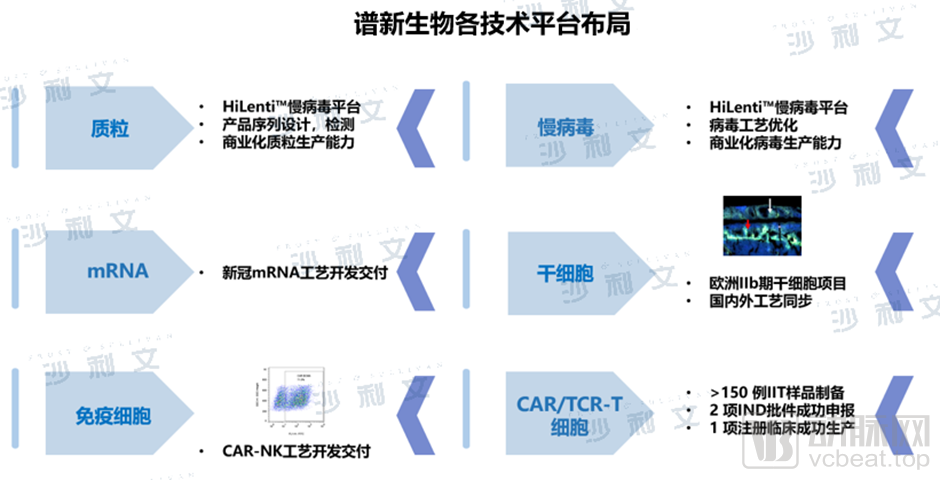

Focusing on the field of cell drugs, Spectrum Biopharma has built an innovative platform that is unique in the industry, including the HiLenti™ lentiviral platform and the HiCellx™ cell technology platform, etc. It is the first CDMO manufacturer industrial transformation evaluation and service platform for cell therapy drug production under the MAH system. Spectrum Biopharma has experience in multiple plasmid process development and pilot production, and has mastered the safe and scalable suspension serum-free cell and disposable reactor lentiviral production processes. It has supported multiple partners to successfully incubate multiple CAR-T, TCR-T, stem cell and other drugs.

Layout of various technology platforms of Spectrum Bio

(Source: Frost & Sullivan)

"Spectrum Bio is the first company in China to realize serum-free suspension culture process, and it is also one of the few CDMO companies that has projects using suspension serum-free lentiviral process and obtained IND implied license." Dr. Zhu Yi said that as the cell medicine industry enters the late stage of industrialization, higher requirements are put forward for the yield, quality and stability of viral vectors. From a technical point of view, the production capacity of virus-adherent cell preparation is sufficient for small-scale research, but for commercial production, the suspension culture system can provide higher yield and quality.

Spectrum Bio's HiCellx™ cell technology platform is equipped with all closed cell production equipment generally recognized by international health regulatory authorities, and has a mature closed cell production platform process, which has supported cell production for multiple projects. "To fundamentally solve the problem of production stability, the premise is to reduce human intervention and use more automated fully closed culture systems for product production. This is the future development trend of the cell therapy industry." Dr. Zhu Yi said.

In terms of capacity construction, Spectrum Bio currently has a 10,000 square meter GMP plant at its Suzhou headquarters and an 8,000 square meter GMP plant under construction at its Shenzhen base, which has initially formed a nationwide production base network. In addition, the North Carolina base in the United States is also under construction to simultaneously carry out the company's global capacity layout. "Spectrum Bio currently has the same level of production capacity and quality system as listed companies of cell drug products. All production facilities and overall construction standards are established for the future commercial production of cell and gene therapy." On January 6, 2022, the General Department of the State Drug Administration publicly solicited opinions on the "Good Manufacturing Practice for Pharmaceuticals-Cell Therapy Products Appendix (Draft for Comments)", which is the second draft for comments on the GMP Cell Therapy Products Appendix. This document takes into account the actual situation of special drugs such as cell products in the production management process, and also puts forward higher management requirements, and requires more stringent content involving various aspects of safety.

"The document has raised the industry's entry threshold and put forward higher requirements for production management. All of our plants at Spectrum Biosciences are built in accordance with the high regulatory standards of Chinese regulatory agencies for cell drugs. Domestic standards even exceed the regulatory standards of the US FDA in some details. Therefore, the implementation of this document from the State Food and Drug Administration is a good thing for the company. Spectrum Biosciences has always considered various issues that need to be considered in the development process from the perspective of making medicines."

"Let cell drugs write a new chapter in life" is the vision of Spectrum Biosciences. Based on their own team capabilities, they maximize their advantages of focus, which is their style of doing things. In the seemingly small sub-segment of cell therapy CDMO, Spectrum Biosciences has a big dream.