The era of cell therapy has arrived, bringing hope to complex and intractable diseases, and CDMO has helped it develop rapidly

In 2021, Fosun Kite's Akilencel injection and WuXi Junuo's Rekiollencel injection were approved successively, and China welcomed two commercial CAR-T products. Cell therapy has entered the era of commercialization in China, and biotechnology companies are also scrambling to layout the cell therapy industry. Why cell therapy is so popular and how CDMO can help cell therapy companies have become hot topics. This article will analyze the development status and market trends of cell therapy and its CDMO.

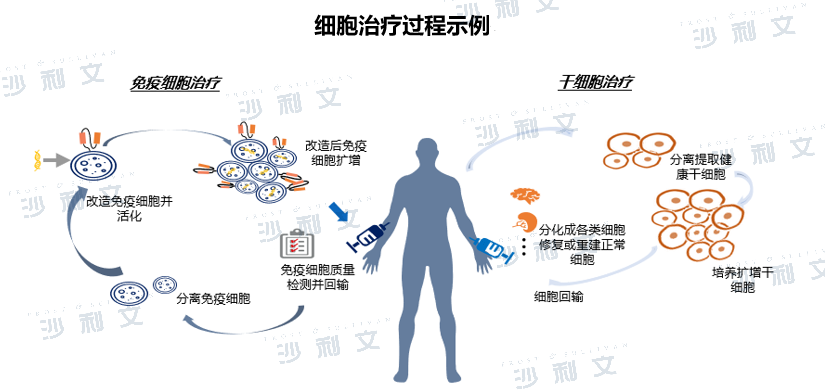

Cell therapy uses bioengineering methods to obtain cells with specific functions and after in vitro amplification, special culture and other treatments, these cells have the functions of enhancing immunity, killing pathogens and tumor cells, so as to achieve the purpose of treating a certain disease. At present, cell therapy can be divided into immune cell therapy, stem cell therapy and other somatic cell therapies. Among them, immune cell therapy refers to the targeted treatment of certain types of immune cells such as T cells, NK cells, B cells, DC cells, etc. in vitro and then re-injected into the human body to make them show functions such as killing tumor cells and clearing viruses. Stem cell therapy usually involves culturing and expanding stem cells and then infusing them back into the patient's body to repair tissues or regulate the immune system to rebuild the microenvironment. The types of stem cells commonly used in clinical practice include mesenchymal stem cells, hematopoietic stem cells, and adipose stem cells.

(Image source: Frost & Sullivan)

Cell therapy has a unique mechanism of action and is more targeted than traditional drugs. Traditional small molecule drugs are distributed not only in diseased tissues or cells, but also in the entire body tissue, which usually causes serious off-target effects. The advantage of cell therapy is that it can actively migrate to the target tissue or target cell to exert its effect, which limits the toxic side effects of the drug to a greater extent.

Based on the unique mechanism of action, cell therapy can provide new treatment options for some diseases that are ineffective and difficult to treat with traditional therapies, and bring long-term efficacy. For example, combined chemotherapy is currently one of the main methods for treating leukemia and lymphoma. Although it can achieve a certain therapeutic effect, most patients have poor efficacy, and there are cases where chemotherapy is ineffective or relapses after chemotherapy. CAR-T has shown amazing therapeutic effects in the treatment of leukemia, lymphoma, and multiple myeloma. By constructing artificially designed CAR molecules into T cells and then infusing these modified CAR-T cells back into the patient's body, it can specifically give the patient's immune cells targeted activation effects, providing new treatment options for patients who are ineffective or relapsed with chemotherapy.

For complex and refractory diseases, cell therapy has obvious clinical benefits compared to small molecule and antibody drugs. Novartis' CAR-T product Kymriah performed well in a phase III clinical trial for the treatment of relapsed or refractory acute lymphoblastic leukemia. 83% of the 63 subjects achieved complete remission, and all patients with complete remission had no micro-residual lesions.

In addition, cell therapy can be used for personalized treatment of specific patients. The optimal dosage of traditional drugs varies from person to person and is difficult to control. However, in cell therapy, synthetic biology can be used to design switches to control the synthesis or release of drugs, and different cell drugs can be designed according to clinical needs to treat more diseases. At the same time, this treatment method can be dynamically personalized and prognosis monitored according to the patient's disease development status.

Although cell therapy has obvious therapeutic advantages, its R&D technology and production process have more difficulties compared with small molecule drugs and antibody drugs. The industrialization of cell therapy includes upstream cell extraction and storage, midstream cell technology R&D, and downstream clinical application. The biggest challenges include the development, optimization and production of cell processes. The process flow of cell products involves multiple steps such as cell culture, activation, transduction, purification, and enrichment, which brings great difficulties to large-scale production.

The quality control of aseptic operation, purity, and safety of preparation results in the production process of cell therapy products has an important impact on the efficacy of the later stage, and has strict requirements for integrated processes and automated equipment. It is very important to ensure the standardization and stability of the production process and to control the efficacy and risks. Therefore, the entire R&D and production process of cell therapy has a high threshold, and the entry barrier of the cell therapy industry is high.

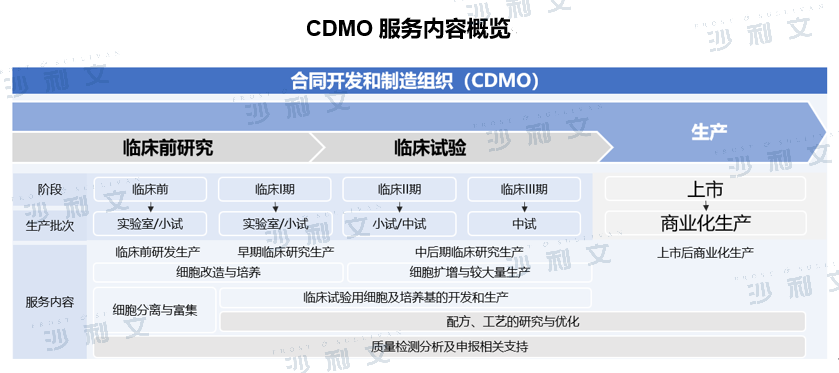

CDMO (Contract Development and Manufacturing Organization), that is, a contract development and production organization, mainly provides clinical new drug process development and preparation, as well as marketed drug process optimization and large-scale production services for multinational pharmaceutical companies and biotechnology companies, including the production of drugs for preclinical and clinical trial research, and commercial drug production. The diverse service content of CDMO companies and the accumulated experience in basic research and development transformation of cell therapy can provide cell therapy companies with services including cell banks, viral vector construction, process optimization, quality inspection, small-scale production in the clinical stage, and later commercial production services. Its professional QA/QC personnel and strict supervision of the entire process can ensure that the production of cell therapy products meets the national GMP quality standards.

(Image source: Frost & Sullivan)

Cell therapy CDMO can empower cell therapy companies, solve many difficulties in their R&D and production, help reduce costs, improve R&D efficiency and commercial success rate. Cell therapy CDMO has opened up a unique segmented track with its R&D advantages and stable production processes, and has become one of the main driving forces for the development of the cell therapy industry.

Cell therapy CDMO companies usually have large cell or vector libraries, which can help pharmaceutical companies select suitable cells or vectors and optimize them, thereby reducing trial and error costs and improving R&D efficiency and success rate. Its rich production platforms and strict quality inspection measures can also help pharmaceutical companies reduce commercial production costs and time. In addition, some cell therapy CDMO companies can provide one-stop new drug clinical trial applications (IND) and new drug marketing applications (NDA) and other regulatory-related services to further help pharmaceutical companies speed up their R&D progress. Cell therapy CDMO can complete the standardized production of target products "faster, better and cheaper", and can also meet customer customization needs, help customers complete applications and achieve stable supply. Cell therapy CDMO has become a market field with great potential, greatly promoting the development of the cell therapy industry.

The cell therapy market will flourish under the impetus of a large number of unmet clinical needs, the emergence of emerging technologies, and favorable policies, promoting the rapid development of cell therapy CDMO

China has a large number of patients with tumors, nervous system, cardiovascular diseases, etc., and there are a large number of unmet medical needs. The potential of cell therapy brings new hope to various complex and intractable diseases such as tumors, and is expected to fill the current clinical needs. The emergence of new technologies and the deepening of clinical research will broaden the development space of the future cell therapy market. The immune cell therapy products on the market are currently concentrated in hematological tumors. New immune cell therapies such as TCR-T and TIL will expand their application in solid tumors. Stem cells are widely used in the research and clinical application of diseases such as the nervous system, cardiovascular, autoimmune and metabolic diseases. These diseases usually have complex mechanisms of treatment. Stem cells can provide effective treatment options through two major functions: tissue repair and immune regulation. At present, the clinical research of induced pluripotent stem cells has gradually shown heat. For example, Vertex Pharmaceuticals' stem cell-derived therapy VX-880 has shown excellent efficacy in the treatment of patients with type 1 diabetes.

The continuous increase in investment in pharmaceutical R&D has stimulated the development of innovative technologies and promoted the market demand for new therapies. In 2020, China's pharmaceutical R&D expenditure was approximately US$24.7 billion, accounting for 12.1% of the global total. Driven by policies, population, and financial dividends, it is expected that by 2025, China's pharmaceutical R&D expenditure will reach US$49.6 billion, accounting for 16.8% of global pharmaceutical expenditure. The compound annual growth rate over the same period was 15.0%, nearly twice the compound annual growth rate of global pharmaceutical R&D expenditure. The growth of R&D expenditure will promote technological innovation and clinical transformation of cell therapy.

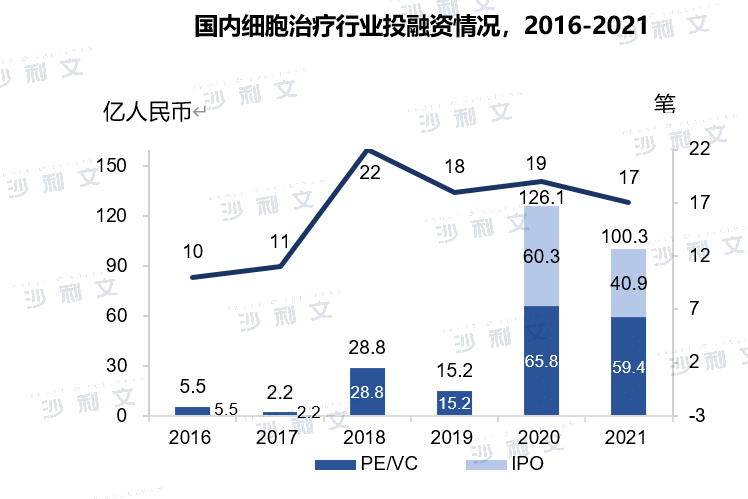

The government continues to introduce favorable policies to promote the emergence of localized products. In recent years, the country has continuously introduced favorable policies and guidelines, and the development of the cell therapy industry has gradually become standardized under clear guiding principles. The "13th Five-Year Plan for National Science and Technology Innovation" issued by the State Council in 2016 and the "13th Five-Year Plan for Bioindustry Development" issued by the National Development and Reform Commission have both formulated incentive policies for industrial development in the field of cell therapy. Government-enterprise cooperation has also promoted the transformation of basic research into a highly innovative cell therapy industry and promoted the rapid development of the cell therapy industry. In addition, the attention of capital in the field of cell therapy continues to increase. The total amount of financing in the field of cell therapy in China in 2020 was approximately RMB 12.6 billion, with a compound growth rate of 118.8% from 2016 to 2020, and the amount of financing has been increasing year by year.

(Image source:Frost & Sullivan)

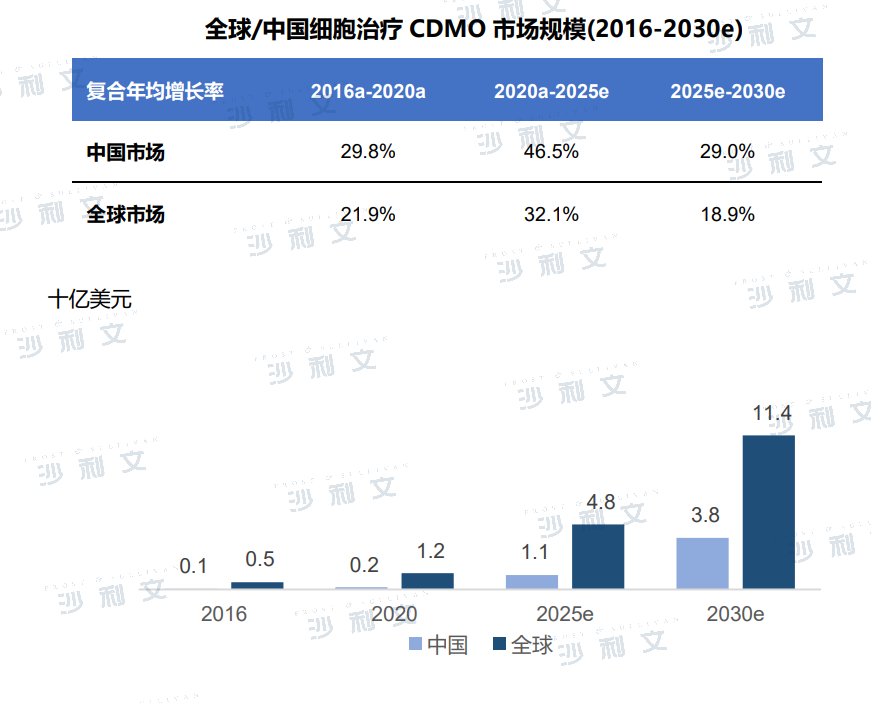

Cell therapy has great potential for clinical application, and the CDMO field has become one of the mainstream directions in the future. At the same time, considering the characteristics of cell therapy research and development and production, and the dependence on the CDMO industry, the demand and stickiness of downstream enterprises for international cell therapy CDMO will steadily increase, and will also give birth to the prosperity and development of cell therapy CDMO. The Chinese government has strict import and export controls on cell therapy products, and the special properties of cells also make their storage and transportation conditions more stringent. The mismatch of supply and demand in the domestic cell therapy field in the short term will give rise to the vigorous development of the domestic cell therapy-related contract outsourcing industry, becoming a stimulus for the development of CDMO companies. The CDMO market is driven by the expansion of the terminal market and the increase in penetration, and has great development potential.

From 2016 to 2020, the global cell therapy CDMO market size increased from US$500 million to US$1.2 billion, with a compound annual growth rate of 21.9%. With the expansion of cell therapy-related research and clinical trials, the compound annual growth rate from 2020 to 2025 will be 32.1%, and by 2030, the global cell therapy CDMO market will reach US$11.4 billion. Due to China's high R&D investment, technological innovation and favorable policies, China's cell therapy CDMO market will grow faster than the global market, with a compound annual growth rate of 46.5% from 2020 to 2025. The market size is expected to reach US$3.8 billion by 2030.

(Image source:Frost & Sullivan)

Cell therapy currently has a large commercialization space, and CDMO has great growth potential

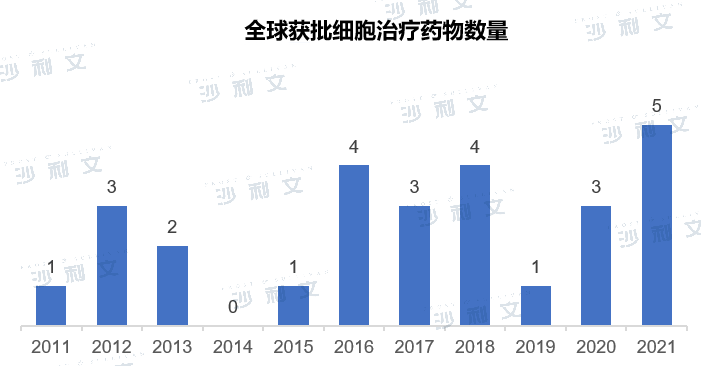

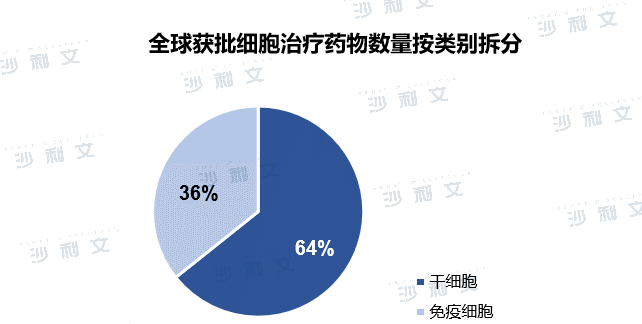

The global cell therapy market mainly includes stem cells and immune cells. 64% of approved cell therapy products are stem cell therapies and 36% are immune cell therapies. At present, there are 19 cell therapy products approved by the US FDA, of which 5 are CAR-T products. There are 9 cell therapy products approved in Europe, of which 3 are CAR-T products. Currently approved stem cell therapies include hematopoietic stem cells (HSC), mesenchymal stem cells (MSC), and to a lesser extent limbal stem cells (LSC). HSC products are mainly approved for the treatment of blood diseases, MSC therapies are suitable for a variety of diseases, including cardiovascular diseases, graft-versus-host disease (GvHD), degenerative diseases and inflammatory bowel disease, and a single LSC product is approved for LSC deficiency. The only therapeutic products approved so far for immune cell therapy are T cells and DC. T cell products are CAR-T therapies for hematological malignancies, while DC products are used as vaccines for solid cancers.

Currently, only 2 CAR-T products have been approved for cell therapy in China, and no stem cell therapy products have been approved. In June 2021, Fosun Kite's FKC876 (Akirensel Injection) was officially approved by NMPA for the treatment of relapsed or refractory large B-cell lymphoma, and China welcomed the first CAR-T treatment product to be launched. In September 2021, Innovent Biologics' JWCAR029 (Rekiorensel Injection) was approved, becoming the second commercialized CAR-T product. China's cell therapy market has a large commercialization space, and cell therapy CDMO has great growth potential.

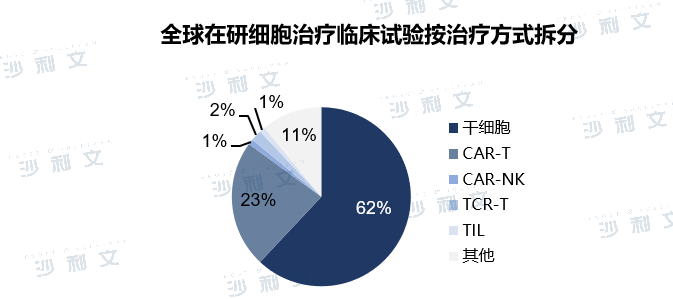

(Image source:Frost & Sullivan)

The global clinical trials of cell therapy under development are mainly concentrated in the fields of CAR-T and stem cells, and other cell therapy methods are still in the early stages of research and development. According to clinical trials on ClinicalTrials.gov, the number of global immune cell clinical trials has doubled in the past six years. Immune cell therapy represented by CAR-T has been continuously upgraded and iterated in the field of hematological tumor treatment, with excellent clinical performance. At present, CAR-T clinical research has begun to expand to solid tumors. In the future, with the successive maturity of other cell therapies such as TCR-T and CAR-NK, immune cell therapy is expected to become an important treatment approach for cancer patients and further improve patient prognosis. As a type of cell with the potential for self-renewal and differentiation, stem cells have shown great potential in many fields such as nervous system diseases, autoimmune diseases, bones and cardiovascular diseases. Due to its extremely wide range of indications, the number of stem cell-related clinical trials is huge, accounting for more than 60% of the ongoing cell therapy clinical trials in the world.

Note: Clinical information is as of October 31, 2021.

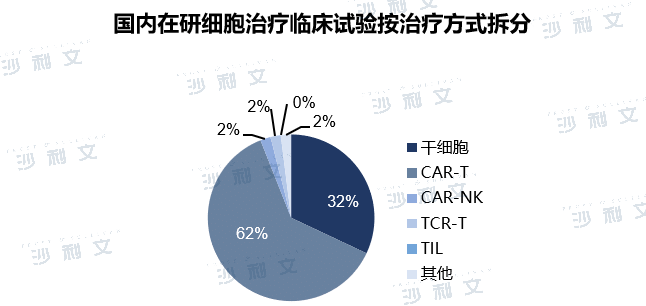

(Image source:Frost & Sullivan)

The clinical trials of cell therapy under development in China are also mainly concentrated in the fields of CAR-T and stem cells. Due to the commercialization of CAR-T products in recent years, CAR-T is very popular in the development of cell products in China, accounting for a large proportion. According to the clinical trials registered by CDE, about 62% of the cell therapies under development in China are in the CAR-T related field, and the targets are mainly concentrated in popular hematological tumor targets such as CD19 and BCMA. At present, two CAR-T products have been approved for marketing in China. With the implementation of national incentive policies and the maturity of related technologies, more cell therapy products will emerge in China in the future to provide effective treatment methods for cancer patients.

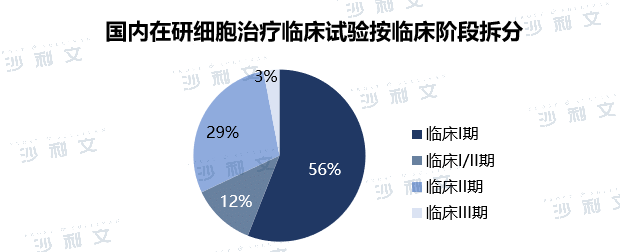

The development of stem cell therapy in China started late, and clinical research and development is currently dominated by mesenchymal stem cells. The indications mainly include transplantation versus host disease, inflammatory bowel disease, rheumatoid arthritis, ischemic stroke, diabetic foot ulcers, etc. After more than ten years of development, the relevant technologies of China's stem cell medical industry have become increasingly mature, and the regulatory system has gradually become standardized. In the future, the market size of stem cells in China will also expand further. From the perspective of clinical stage, 56% of China's cell therapy clinical trials are in clinical phase I, 12% are in clinical phase I/II, 29% are in clinical phase II, and 3% are in clinical phase III. China's cell therapy clinical trials are mainly in clinical phase I, and the research and development of cell therapy is still in the early stages. However, China's number of cell therapy clinical trials is in the leading position in the world, second only to the United States.

Note: Clinical information is as of October 31, 2021.

(Image source:Frost & Sullivan)

As more cell products are commercialized and penetration rates continue to rise, the global cell therapy drug market size will grow from US$1.1 billion in 2020 to US$10.4 billion in 2025, with a compound annual growth rate of 56.3%, and is expected to reach US$37.4 billion in 2030. China's cell therapy products were launched relatively late and are still in the early stages of development. The market size is expected to reach RMB 8.8 billion and RMB 50.1 billion in 2025 and 2030, respectively, with a higher growth rate than the global market. The compound annual growth rates from 2021 to 2025 and from 2025 to 2030 are 144.6% and 41.6%, respectively.

Cell therapy products are one of the fastest growing areas in the global biopharmaceutical market in recent years, and China and the United States are in a leading position in the clinical research and development of immune cell therapies. With the deepening of people's understanding of cell therapy technology and immune cell research, the global cell therapy industry has developed rapidly, and a large number of cell therapy drug research and development have entered the clinical stage. The safety and effectiveness of cell therapy have been greatly improved, and the future market prospects are broad. China is expected to overtake on the curve driven by increased R&D investment and CDMO.

The barriers to cell therapy R&D and bioprocessing are high. CDMO provides overall solutions including bioprocessing solutions and can provide comprehensive services for the cell therapy industry.

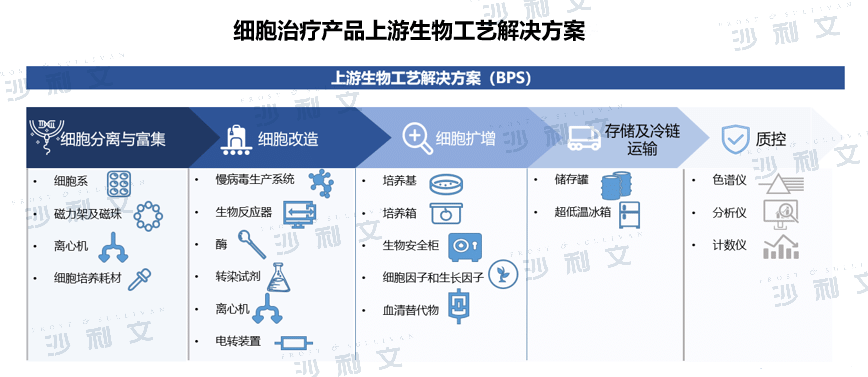

Compared with traditional macromolecule and small molecule drugs, cell products need to build cell banks, select and optimize viral vectors, and culture cells on a large scale. They have strict requirements for quality inspection, batch stability, preparation and transportation, and medication. Among them, upstream bioprocessing solutions are a major barrier to the cell therapy CDMO industry, including upstream cell separation, transformation and amplification. There are technical difficulties in bioprocessing. Due to the challenges of R&D such as the difficulty of large-scale production and high technical barriers to process optimization, companies have a strong desire to outsource R&D and production.

Cell therapy CDMOs that provide overall solutions including upstream bioprocessing can comprehensively and effectively promote the production and commercialization of cell products and have obvious competitive advantages. In addition, process development and optimization, and control of production costs will become the core competitiveness of related companies in the future. Cell therapy CDMOs with drug research capabilities, process development capabilities and production capabilities, through a full range of solutions, penetrate from the front end of drug R&D, provide customized services, help companies improve R&D efficiency and control risks, and ultimately achieve the commercialization of cell products.

(Image source:Frost & Sullivan)

Analysis of important cell therapy CDMOs at home and abroad

The rapid development of cell therapy technology and the continuous expansion of the market have led to a strong willingness to outsource overseas biotech production due to high costs, which has driven the rapid growth of CDMO demand. Cell therapy CDMO has ushered in opportunities for rapid development.

Lonza Pharma Biotech & Nutrition is a leading global CDMO company, recognized for its reliable and high-quality services, global locations, innovative technology platforms and rich experience. CDMO services cover all aspects from the preclinical stage to listing, including discovery research, preclinical stages and clinical commercial trials, providing CDMO services to large pharmaceutical companies such as AbbVie, BMS and Roche. The company achieved revenue of 4.5 billion euros in 2020, an increase of 12.2%. The proportion of cell therapy CDMO business has gradually increased, and it is one of the fastest-growing sectors in terms of revenue. From Lonza's business development trend, it can be seen that the field of cell therapy is one of the mainstream trends in global research and development, and the revenue growth of cell therapy CDMO is stable.

Thermo Fisher, a global life science service giant, acquired Brammer Bio for US$1.7 billion in 2019 and entered the field of cell therapy CDMO services. Thermo Fisher can provide both cell therapy CDMO overall solutions and bioprocess solutions. Laboratory products and services can provide products required for cell therapy drug laboratories, while providing comprehensive pharmaceutical and biotechnology industry outsourcing services for drug development, clinical trials and commercial production. Its life science solutions provide a wide range of reagents, instruments and consumables, covering the entire process of discovery and production of cell therapy products. The company achieved revenue of US$32.2 million in 2020, with Thermo Fisher laboratory products and services and life science solutions accounting for 75.8% of revenue, and the proportion of business revenue continued to increase. The annual compound growth rate of life science solution revenue from 2018 to 2020 reached 24.7%.

For the domestic market, Spectrum Bio is the only provider in China that focuses on cell therapy CDMO overall solutions, providing customers with stable and efficient delivery of CDMO services with a one-body, two-wing business model. Spectrum Bio also has upstream bioprocess solutions and CDMO services for cell therapy, including upstream bioprocessing, clinical trials and commercial production, as well as reagents, instruments and consumables used in the entire process of discovery and production.

Spectrum Biopharma is positioned as a leading cell drug CDMO company. Its shareholders include the National Small and Medium Enterprise Development Fund, the Chinese Academy of Sciences-controlled Guoke Jiahe Fund, Haier Capital, Huabang Health, and CITIC Construction Investment Capital. The company is headquartered in Wuzhong District, Suzhou City, with a registered capital of 100 million yuan. It has Suzhou headquarters (10,000 square meters of GMP plant) and Shenzhen base (8,000 square meters of GMP plant under construction), and has initially formed a nationwide production base network layout. The North Carolina base in the United States is also under construction, and global production capacity layout is being carried out simultaneously.

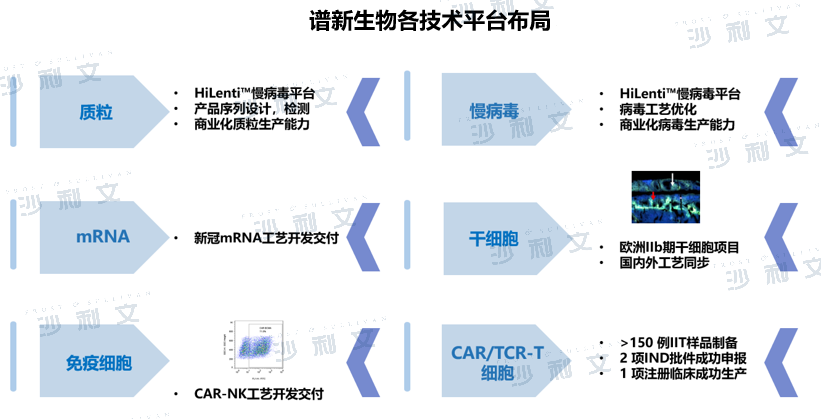

Spectrum Biopharma focuses on the field of cell drugs, and has built a cell drug-specific plasmid construction platform, a suspended serum-free virus production platform, and a fully enclosed cell process development platform. It has experience in multiple plasmid process development and pilot production, and has mastered the safe and scalable suspended serum-free cell and disposable reactor lentivirus production process. In addition, in the field of immune cell CDMO business, Spectrum Biopharma has a mature cell cryopreservation preparation process, a flexible preparation process route, a complete set of closed equipment, and rich application experience.

Spectrum Biopharma has a unique innovation platform (including HiLenti™ lentiviral platform and HiCellx™ cell technology platform, etc.), and is the first CDMO manufacturer industrial transformation evaluation and service platform for cell therapy drug production under the MAH system. The platform has supported multiple partners to successfully incubate a number of CAR-T, TCR-T, stem cell and other drugs. Spectrum Biopharma launched external technical services in 2017, with 150+IIT clinical preparation experience and cooperation resources from 20+ hospitals. Orders exceeded 100 million yuan in 2021. In August 2021, Spectrum Biopharma reached a comprehensive strategic cooperation with Promis Biotech on the commissioned development and production of cell therapy drugs. With its process development capabilities and cell drug GMP production capabilities, it provides CDMO services for Promis's multiple new CAR-T cell drugs.

(Image source:Frost & Sullivan)

By building a process platform from development to production and providing a full-process overall solution, Spectrum Biopharmaceuticals has the ability to quickly achieve discovery to product delivery. Spectrum Biopharmaceuticals provides CDMO technical services including plasmid, lentivirus, and cell process production, covering the entire process from non-registered clinical (IIT), new drug clinical trial application (IND), clinical to commercial production. Spectrum Biopharmaceuticals is committed to enabling more projects to reach the next milestone earlier and faster, bringing more cell drugs to the market, benefiting more patients, and allowing cell drugs to write a new chapter in life.